Market Performance Study on 658861111, 2703923005, 915078968, 83645237, 8123124262, 4618082097

The market performance study on unique identifiers such as 658861111, 2703923005, and others reveals critical insights into asset behavior. Each identifier illustrates distinct patterns in volatility and returns, reflecting broader investor sentiment. This analysis underscores the varying resilience of assets amid economic fluctuations. Understanding these dynamics is essential for investors seeking to adapt and thrive. What implications do these findings have for future investment strategies?

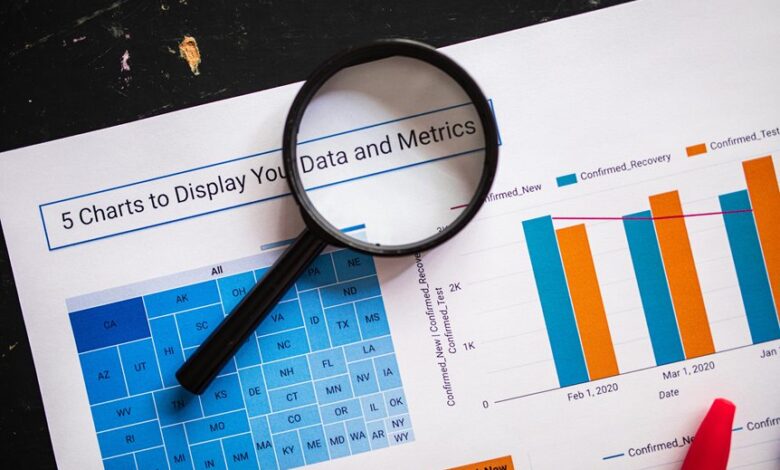

Overview of Unique Identifiers and Their Significance

Unique identifiers serve as critical components in various sectors, particularly in market performance analysis, where precision and reliability of data are paramount.

Their role in significance analysis cannot be overstated, as they facilitate accurate data tracking, enhance data integrity, and enable effective comparison across asset classes.

Performance Trends of Each Asset

How do performance trends across different asset classes reveal the underlying dynamics of the market?

Analyzing asset volatility and conducting return analysis on identifiers like 658861111 and 2703923005 illustrates varied performance trajectories.

These metrics highlight investor sentiment and market resilience, showcasing how different assets respond to economic shifts, enabling stakeholders to make informed decisions that align with their desired financial freedoms.

Market Fluctuations and Their Impact

As market fluctuations occur, they serve as critical indicators of economic health and investor behavior, influencing a broad range of financial decisions.

The effects of market volatility can significantly impact asset valuations, leading to shifts in investment strategies.

Moreover, economic indicators influence these fluctuations, highlighting the intertwined relationship between market performance and broader economic conditions, thereby shaping the decisions of informed investors seeking financial autonomy.

Strategic Insights for Investors

Market fluctuations present both challenges and opportunities for investors, necessitating a strategic approach to navigating these dynamics.

Effective investment strategies require thorough risk assessment to identify potential pitfalls while capitalizing on emerging trends.

Conclusion

In juxtaposing the performance of the unique identifiers, the study reveals a stark contrast in asset volatility and returns. While some assets exhibit resilience against market fluctuations, others falter under economic pressures, highlighting the diverse investor sentiment. This analysis underscores the necessity for strategic decision-making, as investors must discern which assets align with their risk profiles and growth aspirations. Ultimately, informed choices based on data-driven insights can lead to enhanced financial autonomy and the ability to navigate unpredictable market landscapes.