Whole Life Insurance Rates by Age: A Complete Guide

Whole life insurance provides lifetime coverage and special financial advantages, making it an essential financial protection tactic. Whole life insurance guarantees a death benefit to beneficiaries and is active for the duration of the policyholder’s life, in contrast to term life insurance, which offers protection for a certain amount of time. In order to assist you comprehend how age affects your whole life insurance rates by age chart options and costs, this post will go over five key issues about whole life insurance rates.

Age and Premium Calculations – The Fundamental Connection

There is a clear and quantifiable correlation between biological years and financial risk since whole life insurance premiums are inherently correlated with an individual’s age. Because younger people often pose less health risks and have longer possible premium payment periods, insurance firms carefully consider age as a crucial consideration when setting policy premiums. Insurers may develop pricing models that strike a balance between affordability and risk by using this mathematical technique.

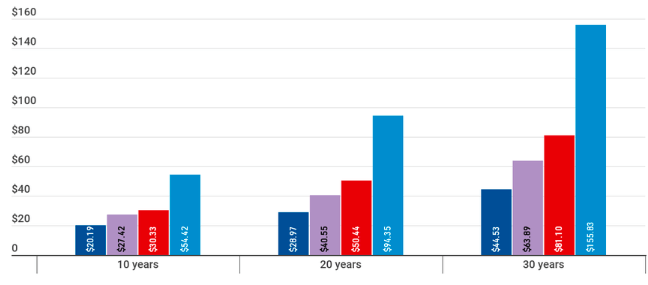

Age-based premium calculations are based on actuarial science, which uses sophisticated statistical models to forecast life expectancy and possible health care risks. Because they are less likely to suffer from major health issues, younger applicants usually benefit from cheaper rates. Early financial planning is crucial since whole life insurance premiums are substantially lower for those in their 20s or early 30s than for those starting their 50s or 60s.

Customers are better equipped to choose their insurance coverage when they are aware of this age-based pricing system. The complete security provided by whole life insurance makes it a worthwhile investment, even when rates rise with age. Potential policyholders should be aware that delaying coverage can lead to significantly higher premiums, so enrolling early is a wise financial decision for long-term stability.

Health Considerations and Age-Related Risk Factors

Health becomes a more important factor in determining whole life insurance rates as people get older. Comprehensive medical exams are carried out by insurance companies, taking into account family medical history, current medical issues, lifestyle variables, and age-related health risks. These thorough evaluations assist insurers in creating complex risk profiles that have a direct impact on coverage eligibility and premium price.

Younger candidates usually go through simpler medical examinations, showing good health markers and frequently needing less paperwork. On the other hand, older candidates may have to go through more stringent medical exams, which might include thorough blood work, cardiovascular evaluations, and thorough checks of their medical records. These thorough assessments enable insurers to precisely estimate any health hazards related to aging.

The dynamic landscape of whole life insurance prices is created by the interaction of age and health. Even as they age, those who are in good health may be able to bargain for better prices. Lifestyle risks being bound to age is an aspect that can be greatly minimized and better insurance premiums that are healthy could be an aspect of health management that involves physical exercise, healthy diet, and early medical check-up.

Financial Planning and Long-Term Investment Perspectives

Whole life insurance provides significant financial planning options for a range of age groups, going beyond conventional protection models. In addition to offering death benefit coverage, this flexible financial tool also builds cash value over time, making it a special investment vehicle that adapts to a person’s shifting financial situation. Comprehending the ways in which aging impacts various investment attributes becomes essential for strategic financial planning.

Longer premium payment terms and the possibility of cash value buildup are advantageous to younger policyholders. Compound interest development and more aggressive growth tactics are made possible by the longer investment horizon. On the other hand, those who are getting close to retirement may place a higher value on security and assured returns, changing their whole life insurance strategy to suit more conservative financial goals.

One important benefit of whole life insurance that grows in value with age is the cash value component. This provision gives policyholders financial flexibility at crucial life phases by enabling them to borrow against their accrued value. The capacity to use this financial resource becomes a crucial factor in complete wealth management methods as people go through different economic periods.

Policy Customization and Age-Specific Flexibility

Whole life insurance plans provide exceptional customisation choices that adjust to a person’s changing living circumstances at any age. Unprecedented flexibility is offered by contemporary insurance packages, which enable policyholders to change the scope of coverage, vary premium payment plans, and add specialty riders that cater to certain life stage needs. Because of its flexibility, insurance coverage is guaranteed to be current and sensitive to shifting financial and personal circumstances.

More comprehensive customization possibilities, such as convertible terms, variable payment schedules, and more growth potential, are frequently advantageous to younger policyholders. People may deliberately adjust their plans as they move through different phases of life to account for changing priorities like starting a family, getting a mortgage, or saving for retirement. With this dynamic approach, whole life insurance becomes a responsive financial planning tool rather than a static safety mechanism.

A customized insurance experience that goes beyond conventional one-size-fits-all models is made possible by the ability to tailor plans. Age-specific risk profiles and personal health concerns can be used to integrate specialized riders like as critical illness coverage, disability income protection, and accelerated death benefits. These customized choices let customers develop all-encompassing protection plans that change as their lives and careers do.

Economic Trends and Age-Related Insurance Dynamics

Whole life insurance prices for various age groups are greatly impacted by broader economic developments. Insurance pricing techniques are always changing due to factors including longer life expectancies, improvements in medical technology, and changing actuarial models. People may invest in insurance at different times of their lives with more knowledge if they are aware of these macroeconomic factors.

Older populations now have more options for insurance due to changes in demographics and better healthcare results. The development of various risk assessment measures also means that what once could not be insured at all, might now be. As a result of this, whole life insurance plans which are a bit cheaper compared to previously mentioned plans, with qualifying criteria that are not as stringent have become possible for people in their 50s 60s and even 70s.

Economic changes, technology developments, and insurance rates are all intertwined to provide a dynamic market with previously unheard-of chances for all-encompassing financial security. Regardless of their age or stage of life, consumers may make smart decisions that support their long-term financial objectives by being knowledgeable about these changing dynamics.

Conclusion

Whole life insurance is a rather complex financial tool that offers clients full financial security regardless of their age. A better understanding of the interdependence between age, health, financial planning and insurance leads to the wise choices, which can secure the person’s financial future.